ESG Strategy at a Glance

Having an ESG Strategy for Businesses is Critical for Survival

In today’s business environment, ESG (Environmental, Social, and Governance) isn’t just a buzzword, it’s a vital strategy for mitigating risks, enhancing reputation, and driving long-term profitability

Beyond Ethics – ESG is Good Business

Companies that embed ESG principles into their operations not only address regulatory pressures and consumer expectations but also unlock competitive advantages such as increased innovation, operational efficiency, and improved investor confidence.

Every Strong ESG Strategy for Businesses Has 4 Key Elements

- Benchmarking: Assess your current ESG maturity and compare it against industry standards.

- Strategy Development: Align ESG goals with core business objectives, setting both short-term and long-term targets.

- Performance Measurement: Use reliable metrics and reporting frameworks to track progress and ensure transparency.

- Compliance & Risk Management: Stay ahead of evolving regulations and mitigate potential risks.

ESG is Not Just a Theory: There Are Many Real-World Success Stories

Case studies from companies like Patagonia, Unilever, and Ørsted demonstrate that a robust ESG strategy can lead to improved market leadership, financial performance, and brand loyalty.

The Future is Now

As ESG reporting becomes mandatory and technology continues to transform sustainability practices, businesses that proactively embrace these trends are best positioned for future success.

Your Next Step

Discover how a tailored ESG strategy can drive growth and resilience for your business. Book a free consultation to explore your ESG potential.

Want to learn more?

Keep reading, your Full Guide to ESG Strategy for Businesses awaits.

- ESG Strategy at a Glance

- Want to learn more?Keep reading, your Full Guide to ESG Strategy for Businesses awaits.

- Mastering ESG: The 3 Essential Pillars You Need to Know

- ESG a Competitive Edge for Forward-Thinking Businesses

- 4 Essential Steps to Implement ESG Successfully

- ESG Strategy for Businesses: Debunking Myths & Understanding Reality

- ESG in Action: 5 Companies Winning with Sustainable Strategies

- The ROI of ESG: How Sustainable Businesses Outperform the Competition

- ESG Meets Innovation: How AI, Blockchain & IoT Are Changing Sustainability

- Technology is the ESG Game-Changer

- The Future of ESG: 3 Key Trends Shaping Sustainable Business

- How Cat Yeldi Consulting Helps Businesses Build an ESG Strategy That Works

In today’s fast-paced business landscape, a strong ESG strategy isn’t just a moral choice, it’s essential for survival. Neglecting ESG can lead to lost investors, boycotts, and costly fines, while companies that get it right unlock a competitive edge that fuels profits, drives innovation, and builds lasting brand loyalty.

Critics may claim that ESG diminishes shareholder value and drives up costs, but real-world evidence tells a different story. Businesses that weave ESG into their core strategies not only outperform their peers financially but also secure market leadership.

This guide will demystify ESG by unpacking its key components, busting common myths, and highlighting inspiring success stories. Discover how you can turn ESG challenges into powerful competitive advantages and future-proof your business.

“Sustainability is a political choice, not a technical one. It’s not a question of whether we can be sustainable, but whether we choose to be.”

— Gary Lawrence, ESG strategist

Mastering ESG: The 3 Essential Pillars You Need to Know

ESG is more than just a corporate responsibility trend—it’s a framework that helps businesses create long-term value while managing risks. Each pillar of ESG—Environmental, Social, and Governance—addresses critical aspects of business operations that influence reputation, financial performance, and stakeholder trust.

A strong ESG strategy doesn’t just mitigate risks; it drives innovation, enhances competitiveness, and opens new market opportunities. In this section, we break down the three pillars and explore how companies can integrate them into their operations for sustainable success.

Pillar 1: Environmental (E)

Sustainable Resource Management

The environmental component of ESG focuses on how businesses manage their impact on the planet. With growing regulations and consumer demand for sustainability, companies must address:

- Carbon footprint reduction through energy efficiency and renewable energy adoption.

- Sustainable supply chains that minimize waste and emissions.

- Circular economy practices that reduce environmental impact and costs.

Sustainable practices aren’t just ethical, they’re good business. Companies that invest in green initiatives see reduced operational expenses and stronger consumer trust.

Pillar 2: Social (S)

Workforce & Community Resilience

The social aspect of ESG is about how companies interact with their employees, communities, and supply chains. A business that values diverse perspectives and builds a resilient workforce is better positioned for long-term success. Key considerations include:

- Workforce development: Investing in employee well-being and skills training.

- Ethical sourcing & human rights protections in supply chains.

- Community engagement and long-term corporate social responsibility (CSR).

A strong social strategy doesn’t just build goodwill—it attracts top talent, improves retention, and enhances brand loyalty.

Pillar 3: Governance (G)

Ethical Leadership & Transparency

Governance is the foundation of corporate accountability. A company’s leadership, decision-making processes, and compliance policies determine its reputation and long-term stability. Key elements include:

- Executive accountability and boardroom diversity.

- Anti-corruption measures and transparent reporting.

- Cybersecurity and data privacy protections.

Good governance reduces risk, increases investor confidence, and ensures a company remains agile in a rapidly changing market.

💡Key Takeaway:

ESG a Competitive Edge for Forward-Thinking Businesses

Understanding the three pillars of ESG is the foundation of building a responsible and future-proof business. Companies that prioritize environmental sustainability, foster strong workforce and community relationships and uphold ethical governance position themselves as industry leaders.

Assess your company’s alignment with the ESG pillars.

Start Your ESG Journey Here

4 Essential Steps to Implement ESG Successfully

Understanding ESG is one thing, implementing it effectively is another. Many companies struggle with where to start, how to measure impact, and how to ensure their efforts align with business goals. A structured approach helps businesses move beyond vague commitments and into actionable strategies that drive measurable success.

In this section, we’ll break down the ESG implementation process into four key steps: assessing current ESG performance, developing a clear strategy, measuring progress, and managing compliance risks.

Step 1: Benchmark Your ESG Maturity

Before setting ESG goals, businesses must evaluate their current position. To conduct an ESG assessment:

- Identify material ESG factors based on industry risks and stakeholder concerns.

- Establish key performance indicators (KPIs) to track carbon footprint, supply chain ethics, diversity, and governance transparency.

- Benchmark against ESG rating systems like MSCI, Sustainalytics, or the Dow Jones Sustainability Index

When benchmarking, it’s important to define and understand

- What’s your ESG baseline?

- How do you compare to competitors?

- Which ESG metrics matter most?

✅ Why It Matters: Companies that skip this step often end up with ESG strategies that lack focus, waste resources, or fail regulatory audits. Benchmarking ensures your ESG efforts are data-driven, competitive, and aligned with stakeholder expectations.

Step 2: Develop an ESG Strategy for Businesses That Drives Growth

An ESG strategy should be integrated into core business operations, not treated as an add-on. The most successful strategies:

- Align ESG goals with financial and operational objectives.

- Set short-term and long-term sustainability targets to track progress.

- Foster an ESG-driven corporate culture from leadership down.

Key Questions to Consider:

- How does ESG align with our core business objectives?

- Are we setting realistic, measurable sustainability goals?

- How can we embed ESG into company culture, rather than treating it as a checklist?

✅ Why It Matters: Businesses that treat ESG as a core business driver, not just a compliance task, see the greatest return on investment – from cost savings to enhanced brand reputation and market competitiveness.

Step 3: How to Measure & Report Performance

Transparency is key to ESG success. Companies should:

- Choose reliable ESG reporting frameworks like GRI, SASB, or ISSB.

- Ensure accurate data collection and analysis to avoid greenwashing risks.

- Communicate progress honestly and effectively with stakeholders.

Key Questions to Consider:

- Which ESG reporting framework best aligns with our industry and goals?

- How can we ensure data accuracy and transparency in our reporting?

- What ESG metrics matter most to investors, regulators, and customers?

✅ Why It Matters: Investors and consumers are increasingly scrutinizing ESG claims—companies that report with integrity, accuracy, and consistency build stronger reputations and long-term trust.

Step 4: A Compliance & Risk Management Guide

As ESG regulations evolve, companies must proactively manage risks to avoid fines, reputational damage, and lost business opportunities. You should:

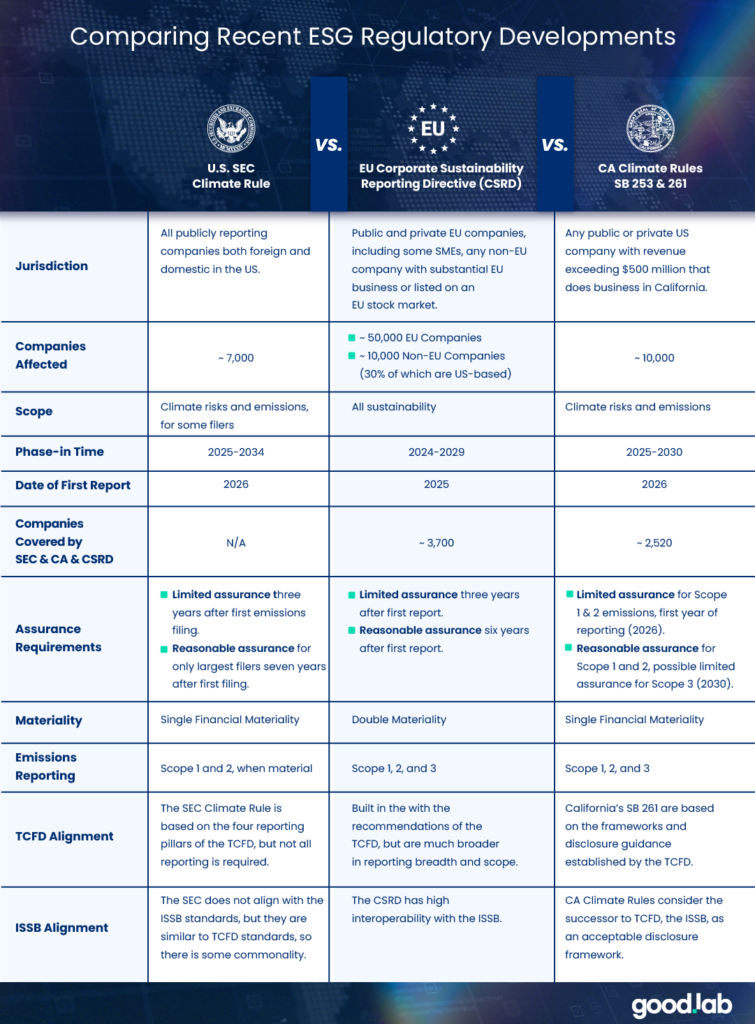

- Stay ahead of global ESG regulations like the EU’s CSRD and SEC climate disclosures.

- Conduct supply chain audits to identify and mitigate ESG-related risks.

- Prepare for ESG-related crises with scenario planning and risk assessments.

Key Questions to Consider:

- What upcoming ESG regulations could impact our business operations?

- Are we prepared to handle ESG-related crises before they arise?

- How can we ensure our supply chain meets sustainability and ethical standards?

✅ Why It Matters: Businesses that approach ESG with compliance AND strategy in mind gain a significant competitive edge—ensuring resilience, investor confidence, and long-term success.

Ready to strategize? Learn how we can help implement your ESG strategy.

ESG Strategy for Businesses: Debunking Myths & Understanding Reality

Despite its growing adoption, ESG remains a controversial topic. Critics argue that it hurts shareholder value, increases costs, and lacks tangible impact. Some businesses hesitate to invest in ESG due to concerns about greenwashing, regulatory uncertainty, or the perception that it’s just a passing trend.

However, the data tells a different story. ESG, when implemented strategically, drives financial performance, enhances risk management, and positions companies as industry leaders. In this section, we debunk common ESG myths and highlight how businesses can turn skepticism into opportunity.

❌ Myth: ESG Hurts Shareholder Value

- Reality: Companies with strong ESG programs experience higher long-term returns and lower financial risk (Harvard Business School, 2019).

❌ Myth: ESG is Just an Overhead Cost

- Reality: Sustainable business models reduce costs and drive innovation—as seen in Unilever’s supply chain strategy.

❌ Myth: ESG is Just Greenwashing

- Reality: Companies that use clear KPIs and report ESG data transparently earn consumer trust and investor confidence.

“Three key things companies need are ambition, authenticity, and alignment. Ambitiousness in their ESG strategy is what’s going to unlock value and innovation.”

— Dirk, ESG leadership expert

💡Key Takeaway:

The Smartest Companies Use ESG to Drive Innovation & Growth

The biggest mistake companies can make is dismissing ESG as a burden rather than an opportunity. Businesses that proactively address these concerns—not by avoiding ESG but by implementing it with transparency and accountability—set themselves apart as resilient, forward-thinking leaders. Those who embrace ESG now will be best positioned to shape the future of their industries.

ESG in Action:

5 Companies Winning with Sustainable Strategies

Integrating Environmental, Social, and Governance (ESG) principles has proven to be a strategic advantage for many companies. The following case studies highlight how leading organizations have successfully implemented ESG initiatives, resulting in enhanced sustainability, innovation, and financial performance.

1. Patagonia: Leading with Purpose

In 2022, Patagonia’s founder transferred ownership of the company to a trust dedicated to combating climate change and protecting nature. This bold move reinforced Patagonia’s commitment to environmental sustainability and solidified its reputation as a purpose-driven brand. As a result, Patagonia was recognized as the most sustainable corporate leader by sustainability professionals, overtaking Unilever, which had held the top spot for over a decade.

2. Unilever: Sustained Commitment to Sustainability

Unilever has consistently integrated sustainability into its business strategy, focusing on responsible sourcing, reducing environmental impact, and enhancing social impact. This long-term commitment has earned Unilever recognition as a global sustainability leader, maintaining a strong reputation among experts and consumers alike.

3. Ørsted: Transition to Renewable Energy

Ørsted, formerly known as DONG Energy, transformed its business model from a focus on fossil fuels to becoming a global leader in renewable energy. By investing heavily in offshore wind farms and divesting from fossil fuel assets, Ørsted has significantly reduced its carbon footprint and set a benchmark for energy companies worldwide.

4. Safaricom: Empowering Communities through Innovation

Safaricom, a leading telecommunications company in Kenya, has been recognized for its sustainability efforts, particularly in promoting financial inclusion through its mobile money platform, M-Pesa. This innovation has provided millions of unbanked individuals with access to financial services, driving economic growth and social development in the region.

5. Prologis: Sustainable Logistics and Real Estate

Prologis, a global leader in logistics real estate, has integrated ESG principles into its core operations. The company has achieved over 500 megawatts of onsite solar generating capacity, contributing to renewable energy adoption and reducing carbon emissions. Prologis’s commitment to sustainability has not only minimized its environmental impact but also enhanced its reputation as a responsible and forward-thinking organization.

💡Key Takeaway:

ESG Drives Reputation, Efficiency & Impact

These case studies demonstrate that integrating ESG principles can lead to significant benefits, including improved brand reputation, operational efficiencies, and positive environmental and social impacts. Companies that proactively embrace ESG are better positioned to navigate the evolving business landscape and meet stakeholders’ expectations.

Want to be among the companies succeeding with ESG? Discover how we can support your ESG journey.

The ROI of ESG:

How Sustainable Businesses Outperform the Competition

One of the biggest misconceptions about ESG is that it is an expense rather than an investment. However, data consistently shows that ESG-aligned companies perform better financially, attract more investors, and reduce long-term risks. As global markets shift toward sustainable business models, ESG is proving to be a driver of profitability, resilience, and investor confidence.

ESG Drives Financial Performance

- Higher Returns: A McKinsey report found that companies with strong ESG performance had 10-20% higher returns on investment (ROI) compared to their peers.

- Lower Cost of Capital: ESG-focused companies experience lower financing costs, as sustainable business models reduce investor risk and increase credit ratings (Harvard Business Review, 2022).

- Operational Efficiency: Businesses that invest in energy efficiency, waste reduction, and ethical supply chains see a direct reduction in costs, boosting profitability.

Investor Trends: The Rise of ESG Investing

- ESG-driven assets under management (AUM) have surpassed $35 trillion globally, accounting for nearly one-third of total managed assets.

- The world’s largest asset managers, including BlackRock and Vanguard, have made ESG a core investment criterion, influencing corporate strategy.

- Consumers are also driving ESG investment—70% of millennials prefer to buy from and invest in sustainable companies.

Regulatory Pressure as a Financial Risk

- Fines & Compliance Costs: Companies failing to meet ESG regulations, such as Europe’s Corporate Sustainability Reporting Directive (CSRD) or SEC climate disclosure rules, risk hefty fines and legal penalties.

- Insurance & Supply Chain Risks: ESG non-compliance can increase insurance premiums and lead to supply chain disruptions as vendors and partners adopt sustainability mandates.

💡Key Takeaway:

ESG is a Strategic Asset, Not a Cost

Far from being a financial drain, ESG is a strategic asset that drives long-term value. Companies that embrace ESG attract top-tier investors, reduce risks, and unlock new market opportunities, while those that lag behind face growing financial and regulatory pressures.

Interested in how ESG can improve your financial performance? Let’s explore the ROI of ESG together.

ESG Meets Innovation:

How AI, Blockchain & IoT Are Changing Sustainability

The future of Environmental, Social, and Governance (ESG) strategies is being shaped by advanced technology. AI, blockchain, and IoT are transforming the way businesses track carbon footprints, verify sustainability claims, and optimize energy efficiency. These innovations are not just making ESG implementation easier—they are making it more transparent, efficient, and financially viable.

AI & Big Data: Smarter ESG Decision-Making

- Predict & Reduce Carbon Emissions – AI-powered analytics forecast environmental impact and identify cost-saving sustainability measures.

- Combat Greenwashing – AI verifies whether companies’ sustainability claims match real-world actions, increasing credibility.

- Automate ESG Reporting – AI streamlines data collection, compliance, and reporting, reducing errors and administrative burden.

✅ Why It Matters: Companies using AI-driven ESG tools report higher efficiency, lower compliance costs, and stronger investor confidence.

Blockchain: Next-Level ESG Transparency

- Verify Ethical Sourcing – Blockchain technology ensures traceability of raw materials, proving ethical supply chains.

- Prevent ESG Investment Fraud – Decentralized ledgers track carbon credits, green bonds, and sustainability investments, preventing misinformation.

- Enhance Trust in ESG Data – Companies like Unilever & Nestlé use blockchain to trace materials from farm to factory, ensuring ethical sourcing.

✅ Why It Matters: Blockchain eliminates ESG data manipulation, providing investors & regulators with verifiable sustainability records.

IoT & Energy Efficiency: Cutting Costs While Reducing Carbon Footprints

- Optimize Energy Use – Smart sensors adjust lighting, heating, and cooling in real-time to reduce energy waste.

- Achieve Carbon Neutrality – IoT helps businesses track and manage energy consumption, automating emissions reduction.

✅ Why It Matters: Smart energy management directly lowers operational expenses while meeting ESG goals.

💡Key Takeaway:

Technology is the ESG Game-Changer

Businesses that integrate AI, blockchain, and IoT into their ESG strategies are gaining a competitive edge—reducing costs, increasing transparency, and future-proofing operations. Those who delay ESG tech adoption risk falling behind.

Technology is revolutionizing ESG. Learn how to leverage AI & blockchain for sustainability.

The Future of ESG:

3 Key Trends Shaping Sustainable Business

ESG is rapidly evolving. What was once a voluntary initiative is now becoming a global business-standard. Companies that anticipate these shifts will not only stay ahead of regulations but will also shape the future of their industries.

The Shift from Voluntary to Mandatory ESG Reporting

- Governments worldwide are tightening ESG disclosure requirements.

- The EU’s Corporate Sustainability Reporting Directive (CSRD) will affect 50,000+ companies, requiring transparent sustainability reporting.

- The SEC’s climate disclosure rule will impact public companies, requiring them to report climate-related risks and emissions data.

Industry-Specific ESG Innovations

- Fashion: Brands like Patagonia are pioneering circular economy models, using recycled materials to minimize waste.

- Energy: Companies like Ørsted are investing in carbon capture and large-scale renewables to meet net-zero goals.

- Food & Agriculture: Firms like Nestlé are adopting regenerative farming practices to combat deforestation and improve soil health.

The Future of ESG Investing

- ESG bond markets are projected to hit $1 trillion annually as investors shift toward sustainable finance (Bloomberg, 2024).

- Major banks are tying loan terms to ESG performance, rewarding companies that reduce emissions and increase sustainability efforts.

- Sustainable ETFs continue to outperform traditional index funds, showing long-term market confidence in ESG strategies.

💡Key Takeaway:

Innovation & Regulation Will Define the Future

The future of ESG is data-driven, regulation-focused, and innovation-led. Companies that proactively adopt ESG trends and leverage emerging technologies will not only comply with evolving standards but also gain a competitive edge in the marketplace.

Stay ahead of the curve. Get expert insights on ESG trends.

How Cat Yeldi Consulting Helps Businesses Build an ESG Strategy That Works

ESG isn’t just a checkbox—it’s a transformative opportunity. At Cat Yeldi Consulting, we empower your business to unlock hidden value, drive innovation, and secure long-term success through tailored ESG strategies. Don’t miss out on the competitive edge that comes with a robust ESG approach.

Our Services Include:

• ESG Risk Assessment & Compliance Planning

Identify and mitigate risks while ensuring your operations meet evolving regulatory standards.

• Corporate Sustainability Strategy Development

Craft a customized sustainability roadmap that aligns with your core business objectives.

• ESG Reporting & Data Analysis

Leverage transparent, data-driven insights to build stakeholder trust and support strategic decisions.

• Technology-Driven ESG Integration

Utilize cutting-edge digital tools to streamline ESG initiatives and optimize performance.

Ready to turn ESG challenges into competitive advantages? Book your free strategy session today and get a personalized roadmap to achieving your ESG goals.

Get in Touch

References:

- Eccles, R. G., Ioannou, I., & Serafeim, G. (2019). The business case for ESG. Harvard Law School Forum on Corporate Governance. Retrieved from [https://corpgov.law.harvard.edu/2019/06/04/the-business-case-for-esg/]

- Whelan, T., Atz, U., Van Holt, T., & Clark, C. (2021). ESG and financial performance: Uncovering the relationship by aggregating evidence from 1,000+ studies published between 2015–2020. NYU Stern Center for Sustainable Business. Retrieved from [https://www.stern.nyu.edu/sites/default/files/assets/documents/NYU-RAM_ESG-Paper_2021%20Rev_0.pdf]

- Stedman, C., & Paul, L. G. (2024). 10 top ESG reporting frameworks explained and compared. TechTarget. Retrieved from [https://www.techtarget.com/sustainability/feature/Top-ESG-reporting-frameworks-explained-and-compared]

- Karaosman, H., & Marshall, D. (2025). ESG case studies. Wharton ESG Initiative. Retrieved from [https://esg.wharton.upenn.edu/]

- Torri, G., Giacometti, R., Dentcheva, D., Rachev, S. T., & Lindquist, W. B. (2023). ESG-coherent risk measures for sustainable investing. arXiv preprint arXiv:2309.05866. Retrieved from [https://arxiv.org/abs/2309.05866]

- Mitchenall, T. (2023, December 14). Seven quotations that sum up the year. New Private Markets. Retrieved from [https://www.newprivatemarkets.com/seven-quotations-that-sum-up-the-year/]

- The unintended consequences of ESG investing—and how to prevent them. (2024, September 11). Financial Times. Retrieved from [https://www.ft.com/content/831ead3f-85da-47f9-b4f9-e515029fb4b1]

- Prologis. (2023). Sustainability and ESG initiatives. Retrieved from [https://www.prologis.com/sustainability]

- Patagonia. (2023). Our mission: We’re in business to save our home planet. Retrieved from [https://www.patagonia.com/home/]

- Ørsted. (2024). From fossil fuels to green energy: Our transition story. Retrieved from [https://orsted.com/en/about-us/our-history]

- ESG News. (2023). Sustainability is a political choice, not a technical one—Gary Lawrence. Retrieved from [https://esgnews.com/quote/sustainability-is-a-political-choice-not-a-technical-one-its-not-a-question-of-whether-we-can-be-sustainable-but-whether-we-choose-to-be/]

- Thrive HR Exchange. (2023). Three key things companies need are ambition, authenticity, and alignment—Dirk. Retrieved from [https://www.thrivehrexchange.com/insights/in-brief-top-quotes-from-thriving-leaders-series-session-3]

- Benchmark Gensuite. (2022). Top 10 quotes from the 2022 Benchmark Gensuite Impact Conference—Andy Karsner. Retrieved from [https://benchmarkgensuite.com/ehs-blog/top-10-quotes-from-the-2022-benchmark-gensuite-impact-conference/]